[ad_1]

|

| Tran Nguyen, monetary service advisor Ipsos Strategy3 |

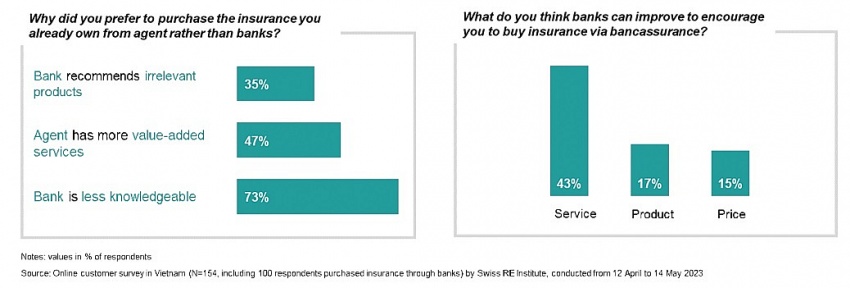

Bancassurance, regardless of being a big contributor to the trade’s success, has been on the centre of controversy. Mis-selling scandals shook the market’s basis, inflicting public belief to wane. A survey in Vietnam performed by Swiss RE Institute in April-Might 2023 in the course of the peak of mis-selling incidents revealed public dissatisfaction.

The first complaints centred round poor service high quality, irrelevant merchandise, and a perceived lack of know-how amongst financial institution staff in regards to the merchandise they have been promoting. The first reason behind substandard service high quality is commonly traced again to mis-selling, an issue that may manifest in varied bancassurance gross sales fashions.

There are two important threat components that result in a probability of mis-selling. The primary threat is when banks function independently, with their referral groups selling insurance coverage merchandise that provide excessive commissions and incentives for the workers. The second threat arises from moments between financial institution and insurance coverage staff, the place each the financial institution’s referral group and the insurance coverage specialists are neglectful, promoting unsuitable merchandise.

Within the context of the direct gross sales mannequin as one other instance, the place the financial institution’s personal staff interact with and promote their bancassurance merchandise on to the buyer, devoid of any intervention from insurers or different financial institution specialists. The mis-selling phenomenon is most probably to be encountered in case of lending merchandise.

The bancassurance gross sales group could resort to aggressive promoting techniques, compelling clients to go for insurance coverage. The most common situations when mis-selling can transpire embrace the levels earlier than utility appraisal, contract signing, and previous to mortgage disbursement.

In contrast to Thailand, Malaysia, and the Philippines, the place brokers and brokers lead, Vietnam’s reliance on bancassurance requires strict administration akin to mature markets equivalent to Hong Kong, Taiwan, and South Korea. Bancassurance’s contribution to new life insurance coverage coverage premiums dramatically elevated from 21 per cent in 2018 to 50 per cent in 2023.

Nevertheless, Vietnam’s market could face the same destiny to China’s, which noticed a big discount in gross sales after tightening laws. If we take a look at bancassurance in China, after a peak of the contribution to the life insurance coverage premium, the federal government oversight to tighten and regulate the gross sales behaviours of bancassurance has resulted in a significant lower in gross sales of life insurance coverage by way of the bancassurance channel, from 60 per cent in 2010 to 32 per cent in 2021.

The following chapter of Vietnam’s bancassurance may very well be just like the Chinese language market over 10 years in the past. Life insurance coverage in Vietnam, though in its nascent levels, presents alternatives for exponential progress. The potential for growth is immense, regardless of the bancassurance-led distribution mannequin’s stability challenges, which additionally opens avenues for brand new, modern distribution methods.

The life insurance coverage penetration fee, at the moment at 11 per cent in 2022, signifies an unlimited, untapped market able to discover life insurance coverage choices. Its modest contribution of 1.87 per cent to the GDP in 2022 holds promise for vital financial affect sooner or later. Subsequently, whereas the trail to sustainable progress could have obstacles, the longer term is ripe with prospects and thrilling prospects.

The enactment of a brand new Legislation on Credit score Establishments, is about to carry stricter regulation and oversight to the bancassurance sector. The legislation goals to reinforce buyer safety, enhance governance and threat administration, and foster collaboration between authorities, banks, and insurance coverage firms.

The legislation additionally prohibits credit score establishments from packaging insurance coverage merchandise with banking merchandise. This elevated oversight will encourage insurance coverage firms to rethink their bancassurance channels and discover alternate options, equivalent to digital, whereas banks might want to enhance their gross sales fashions to keep away from regulatory infringements.

There can be challenges in rebuilding buyer religion and delivering constant companies, and banks will want motion plans to bolster model picture, preserve buyer satisfaction, and work on choosing appropriate gross sales fashions.

|

Nevertheless, there are alternatives for banks and insurers. One such alternative lies within the reinvention of distribution channels and gross sales fashions. Insurers would possibly cut back their reliance on monetary establishments, and as a substitute, discover the potential of self-developed digital platforms like cell purposes. These platforms can streamline processes and enhance buyer assist, thereby enhancing the general buyer expertise and constructing belief and loyalty amongst clients.

Insurers also needs to enhance present channels equivalent to brokers, direct gross sales, {and professional} distributors. When bancassurance is restricted, insurers should know their clients, notably these transitioning from the bancassurance channel. Insurers have to handle the change of transitioning of shoppers rigorously, present correct communication in regards to the change whereas preserve the standard of service to make sure easy transition.

For banks, a complete reevaluation and reinvention of their bancassurance gross sales fashions can be a vital step in navigating the regulatory panorama successfully. To align with the brand new scrutiny positioned on bancassurance, banks might want to streamline their operations, optimise inside processes, and give attention to core banking actions, all whereas guaranteeing compliance with stringent laws.

Nevertheless, as we replicate on previous situations of mis-selling, it turns into clear that rebuilding buyer belief is not any small activity. To beat this problem, banks should prioritise transparency of their promoting practices, together with offering complete and correct details about their merchandise.

Whereas the trail to sustainable progress could have potential obstacles, the way forward for the bancassurance is ripe with prospects and thrilling prospects. Banks should foster nearer collaborations with insurance coverage firms. It will allow them to supply standalone insurance coverage merchandise designed to satisfy the distinctive wants of their clients, thereby enhancing buyer satisfaction, cross-selling, and loyalty.

|

Hanoi pays consideration to bettering high quality of individuals’s life

As some of the populous cities within the nation with a inhabitants of about 10 million folks, the capital metropolis of Hanoi has confronted loads of social points regarding safety and order, social evils and employment. |

|

Fund for social insurance coverage to be bolstered

Efforts are gearing in direction of bettering the related regulatory system for social insurance coverage fund effectivity, additional fostering financial growth in addition to social wellbeing. |

[ad_2]